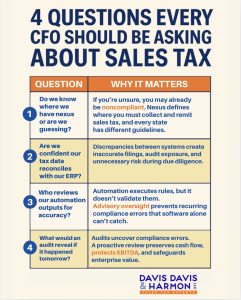

4 Questions Every CFO Should Be Asking About Sales Tax

Most CFOs are laser-focused on EBITDA, cash flow, and scaling.

But there’s a silent driver of enterprise value that often gets ignored until it’s too late.

Sales tax.

That’s why every finance leader should be asking these four questions:

1. Do we know where we actually have nexus?

2. Does our tax data reconcile with our ERP, or do we just hope it does?

3. Who is validating the outputs of our automation tools?

4. What would an auditor find if they walked in tomorrow?

If you can’t answer all four with confidence, the risk isn’t theoretical.

Risk is already there, sitting quietly in the numbers you depend on.

At Davis Davis & Harmon LLC – Sales Tax Experts, we help CFOs and PE-backed companies uncover these gaps before they hit cash flow, margins, or valuation.

Sales tax isn’t just compliance.

It’s risk management.

It’s enterprise value protection.

It’s part of the growth conversation.

👉 Let’s make sure your answers reflect reality, not assumptions.

📩 Davis Davis & Harmon LLC | Sales Tax Experts

#SalesTax #CFO #FinanceLeaders #PrivateEquity #EnterpriseValue #AuditRisk #DDHSalesTaxExperts #TeamDDH #VentureBacked

About Davis Davis & Harmon LLC – Sales Tax Experts: Headquartered in Dallas, Texas, Davis Davis & Harmon LLC – Sales Tax Experts specializes in sales/use tax refund recovery and audit defense. Our team of consultants is comprised of former Big 4 sales tax consultants and state sales tax auditors. Each of our consultants has 15 to 20 years of experience, providing our clients with access to a highly specialized team of sales/use tax professionals. At Davis Davis & Harmon, LLC, we are committed to maintaining the highest standards in our talent pool. We work hard to meet our clients’ needs by ensuring that you view our firm as an extension of your company and a member of your team.