The Economics of Sales Tax

MULTISTATE: According to the 2017 COST State and Local Business Tax Burden Study, more than $724 billion was paid in state and local taxes signifying a .9% increase from the previous year. This growth is attributable to property and sales taxes paid by businesses. Businesses pay more in property and sales tax than any other tax.

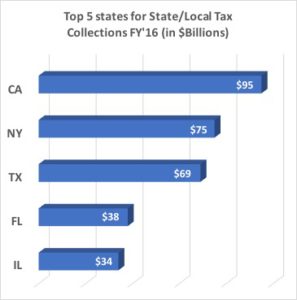

Sales ax is the largest tax paid by businesses for state taxes. It accounts for 31.9% of all state taxes. 34 of the 45 states with a state sales tax experienced an increase in collection in 2016. Washington, New York and California had increases over $350 million. When reviewing sales tax on a state and local level, it is the second largest tax paid by businesses behind property taxes. It accounts for 21.3% of the total state tax collections.

About Davis & Davis LLC – Sales Tax Experts: Headquartered in Dallas, Texas, Davis & Davis LLC – Sales Tax Experts specializes in sales/use tax refund recovery and audit defense. Our team of consultants is comprised of former Big 4 sales tax consultants and state sales tax auditors. Each of our consultants has 15 to 20 years of experience, providing our clients with access to a highly specialized team of sales/use tax professionals. At Davis & Davis, we are committed to maintaining the highest standards in our talent pool. We work hard to meet our clients’ needs by ensuring that you view our firm as an extension of your company and a member of your team.

For sales/use tax compliance questions or audit-related concerns, we are here to help!

Contact us at:

Or call today for a consultation:

972-488-5000