TX Proposed Constitutional Amendment

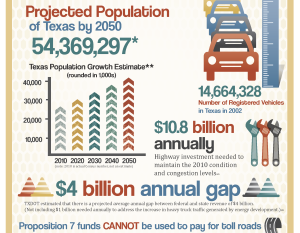

TEXAS: Per Ballotpedia.org, The Texas Sales and Use Tax Revenue for Transportation Amendment, Proposition 7 is on the November 3, 2015 ballot in Texas as a legislatively-referred constitutional amendment. The measure, upon voter approval, would provide additional funding for the State Highway Fund.

The amendment would dedicate $2.5 billion of revenue from the sales and use tax annually to the State Highway Fund starting on September 1, 2017. This allocation would expire on September 1, 2032. Beginning September 1, 2019, 35 percent of revenue from the sales and use tax on motor vehicles exceeding $5 billion would be dedicated to the State Highway Fund annually. For example, if $6 billion came in from this tax source, then 35 percent of $1 billion, or $350 million, would be dedicated to the fund. This allocation would expire on August 31, 2029.

This new revenue for the State Highway Fund would be used to construct and maintain non-tolled roadways, purchase rights-of-way and make payments on general obligation bonds issued by the Texas Transportation Commission.

The Texas Legislature would be allowed to reduce the amount of sales and use tax revenue allocated to the State Highway Fund if two-thirds of legislators agree to do so. The legislature would also be permitted to extend these revenue allocations beyond their expiration dates for 10-year periods if a simple majority of legislators agree to do so.

If voters pass the amendment, it “would be the largest single increase in transportation funding in Texas history,” according to amendment author Sen. Robert Nichols.

This is the second question in two years asking voters to divert existing revenue to the State Highway Fund. In 2014, Texans agreed Proposition 1, which authorized the legislature to allocate money from the Rainy Day Fund to the State Highway Fund.

The measure was introduced into the Texas Legislature by Sen. Robert Nichols and Sen. Jane Nelson as Senate Joint Resolution 5.

Quote from Bill Hammond (CEO of the Texas Association of Business)- “The plan to constitutionally dedicate a portion of the motor vehicle sales tax revenue to transportation projects is exactly what the business community has called for, and we will strongly support this proposed constitutional amend. Texas must continue to build and improve infrastructure to support our fast growth and dynamic economy. I believe this plan will go a long way in providing a stable source of revenue to built non-tolled projects that will help keep our state moving.”

About Davis & Davis LLC – Sales Tax Experts: Headquartered in Dallas, Texas, Davis & Davis LLC – Sales Tax Experts specializes in sales/use tax audit consulting and audit defense. Our team of consultants is comprised of former Big 4 sales tax consultants and state sales tax auditors. Each of our consultants has 15 to 20 years of experience, providing our clients with access to a highly specialized team of sales/use tax professionals. At Davis & Davis we are committed to maintaining the highest standards in our talent pool. We work hard to meet our clients’ needs by ensuring that you view our firm as an extension of your company and a member of your team.

For sales/use tax compliance questions or audit related concerns, we are here to help!

Contact us at:

Or call today for a consultation:

972-488-5000